Collective Health: Replacing Insurance With Software

/Technology startups are starting to make inroads and affecting (in a small way) some of the biggest players in healthcare.

One startup, Collective Health, began when one of the founders broke his foot. Instead of choosing to got the regular rout for an MRI that would have cost him $3,700 with a $1,500 deductible, he paid just $600 cash that day without going to his insurance provider. That transaction gave Ali Daib the idea for Collective Health, a new employer health program that recently launched with the promise to take the paperwork and time-sucking hassles out of health insurance.

Diab and co-cofounder Dr. Rajaie Batniji, a physician and political economist at Stanford University, paint Collective Health as a way to cut out the middleman (health insurance) and instead offer employers a less expensive, cloud-based, a la cart version of health care coverage for their workers. Employers can pick and choose which things they want covered for their employees.

From a story on TechCrunch: link

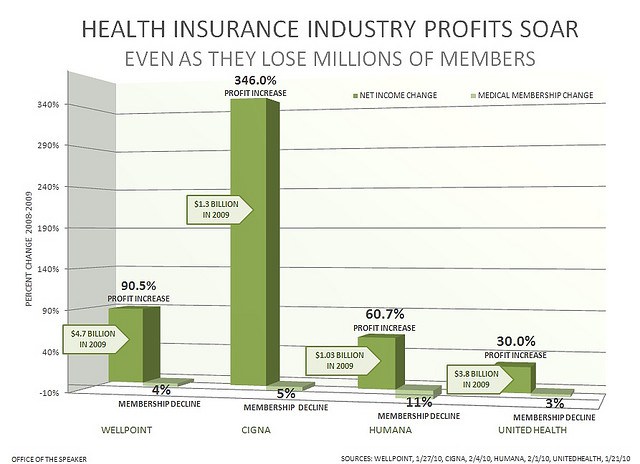

“Patients are often left to advocate for themselves and trying to get a clear answer from your health insurance company about what’s driving costs is impossible,” says Dr. Batniji. According to NerdWallet, one in every 5 American adults are struggling to pay their medical bills, and three in five bankruptcies will be due to medical bills. And to add more insult to any possible injuries, over the last 10 years, the average premium for family coverage has increased 80 percent, according to ACA International. It was a 90 percent increase from 2008 to 2009, according to data provided from Wellpoint, Cigna and United Health (see chart below).

The problem, according to Diab and Dr. Batniji, is that even with Obamacare or employee sponsored health insurance, annual premiums are increasing. They say the costs are growing at an unsustainable rate for most small and midsize companies to handle. This, according to Diab, makes it hard to offer a good plan for employees. “While insurance is supposed to be a risk-sharing business, health insurance has increasingly become a middleman business devised to generate profit for the health insurers above all else. As a result, there is a fundamental disconnect between the incentives of traditional health insurance companies and people’s and organizations’ health insurance needs,” says Diab.